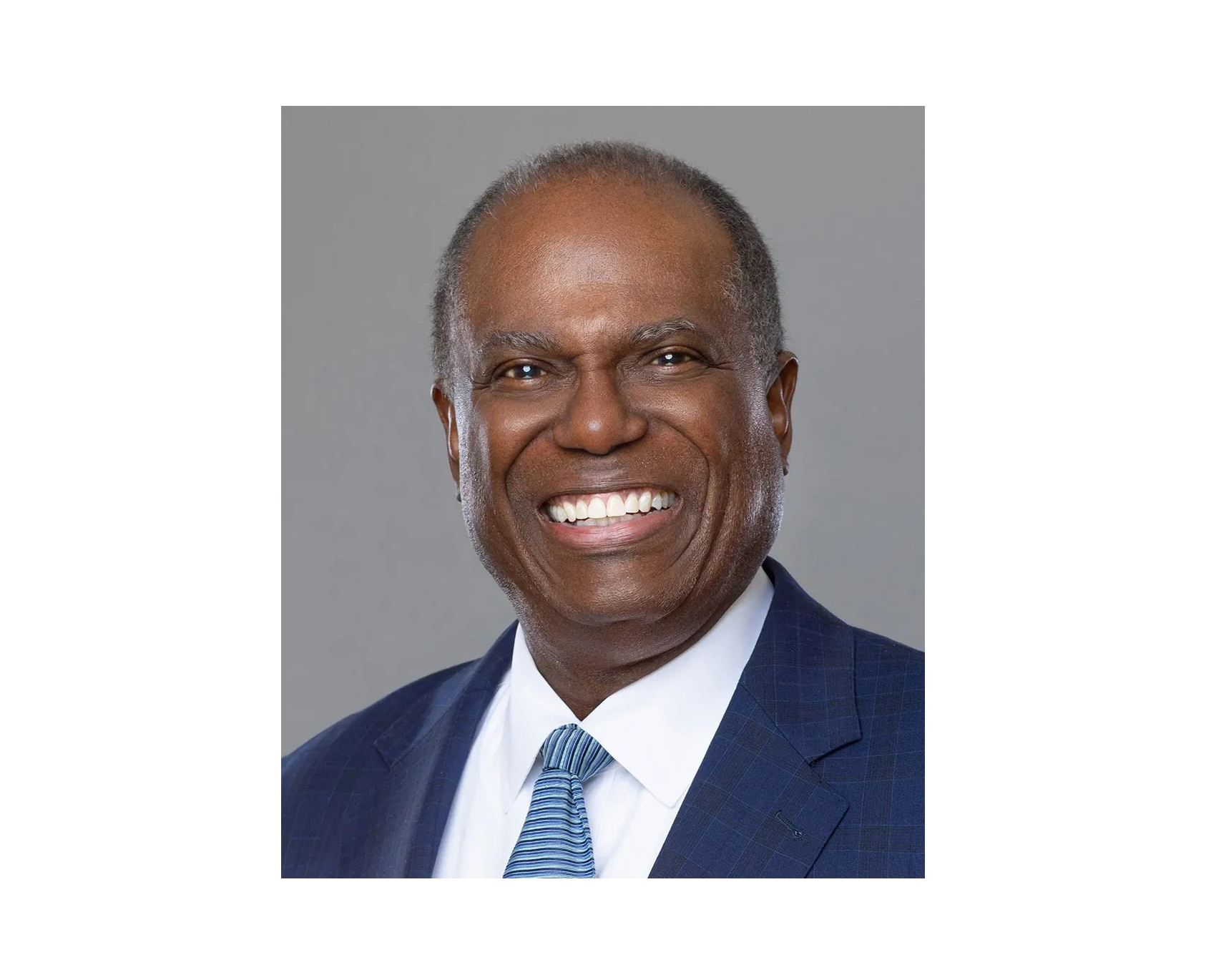

By Eric Gaus of Dodge Construction Network

The weakening of Federal Reserve independence likely will increase the cost of doing business across the board, and, in such case, the surety industry will feel those costs. President Trump has made clear his desire for lower interest rates and is pushing Federal Reserve officials to meet his demands. He issued strongly worded statements, and has attempted to fire one Governor, Lisa Cook, an executive action under federal judicial review as of the writing of this article. Further, the Administration has escalated its pressure by initiating a criminal investigation of Jerome Powell, the sitting Fed Chairperson.

Most economists view these actions as counterproductive, especially in view of long-term economic interests. While the President may ultimately be successful in manipulating the Federal Reserve to lower short-term rates, the loss of central bank independence makes it unlikely that the long-end of the yield curve, the interest rates that matter, will fall. If cuts are successful at stoking the economy, higher inflation becomes a significant risk, and, along with that, higher inflation expectations. Inflation expectations are imbedded in longer term interest rates so, when they rise, so too will lending rates. Even if expectations remain anchored, the perception that the Federal Reserve is “captured” by the Chief Executive will increase the risk premium for longer dated bonds.

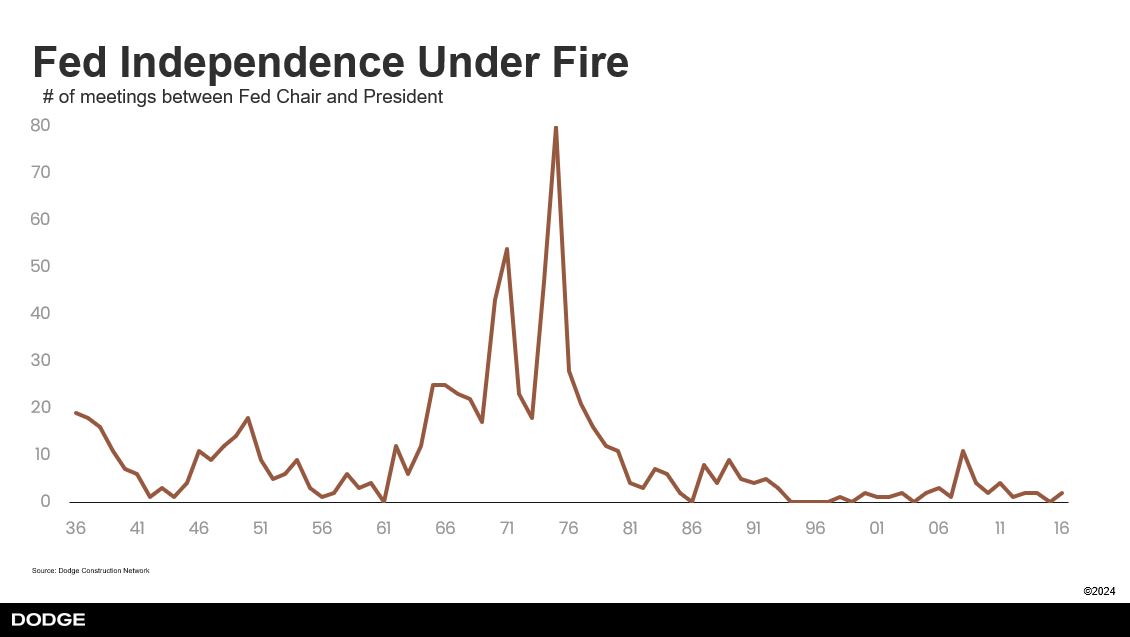

We have been down this path before when President Nixon applied pressure to the Federal Reserve in the early 1970s (see Chart). It is no coincidence that all those meetings between President Nixon and the Fed Chair resulted in accommodative policy decisions and, as a result, the nation experienced a prolonged stagflationary period. Stagflation is a period of slow growth coupled with high inflation from which recovery can be very painful.

The odd part about the current situation is that Jerome Powell’s term as Chair will run out in just a few months, and the present monetary policy stance is not that restrictive. The neutral rate, that theoretical rate at which the Fed is neither accommodating nor restricting economic growth, is unknown, generally believed to have been around 3 percent. However, estimates range from 2.5 to 3.5 percent. The current Fed funds rate target is 3.5-3.75 percent, just on the outer edge of neutral rate range, as compared to the above 4 percent target we had for most of 2025.

Although markets have not priced in a captured Fed yet, these actions by the Administration make it increasingly likely that bond and equity markets will exhibit some turbulence in the coming year. For surety professionals this evolving situation presents risks on both sides of the ledger. Assets could lose value at inopportune moments, and the cost of borrowing may be higher than anticipated. Consequently, prudent actions may mean managing risks appropriately in safer short-term vehicles, thereby lowering the need for lending and ensuring sufficient liquidity.

The views expressed in this article are solely those of the author and do not necessarily represent those of NASBP.

Eric Gaus is Chief Economist at Dodge Construction Network, where he directs economic research. He brings over 15 years of experience in academia and the private sector, creating macroeconomic models and producing research on critical issues for the global economy. Prior to joining Dodge, Gaus was a Director at Moody’s, where he managed the development and maintenance of their global forecasting model and served as the product manager of their country risk service. He received his PhD from the University of Oregon and spent several years teaching at small liberal arts colleges. While in academia, Gaus published articles on the role of expectation formation in macroeconomics and finance. He can be reached at Eric.Gaus@construction.com.

Eric Gaus is Chief Economist at Dodge Construction Network, where he directs economic research. He brings over 15 years of experience in academia and the private sector, creating macroeconomic models and producing research on critical issues for the global economy. Prior to joining Dodge, Gaus was a Director at Moody’s, where he managed the development and maintenance of their global forecasting model and served as the product manager of their country risk service. He received his PhD from the University of Oregon and spent several years teaching at small liberal arts colleges. While in academia, Gaus published articles on the role of expectation formation in macroeconomics and finance. He can be reached at Eric.Gaus@construction.com.

Get Important Surety Industry News & Info

Keep up with the latest industry news and NASBP programs, events, and activities by subscribing to NASBP SmartBrief.