By Sarah Martin of Dodge Construction Network

Over the past five years, megaprojects have become increasingly influential within the construction sector. Manufacturing plants and data centers, in particular, accounted for nearly two-thirds of total megaproject construction starts between 2020 and 2025. Unprecedented levels of funding poured into the manufacturing sector in 2021 and 2022, as pandemic-induced supply chain disruptions and interest in semiconductor chips drove demand for high-tech manufacturing. At the same time, growing advancements in cloud platforms and artificial intelligence created enormous growth in data center construction in recent years.

How is a Megaproject Defined?

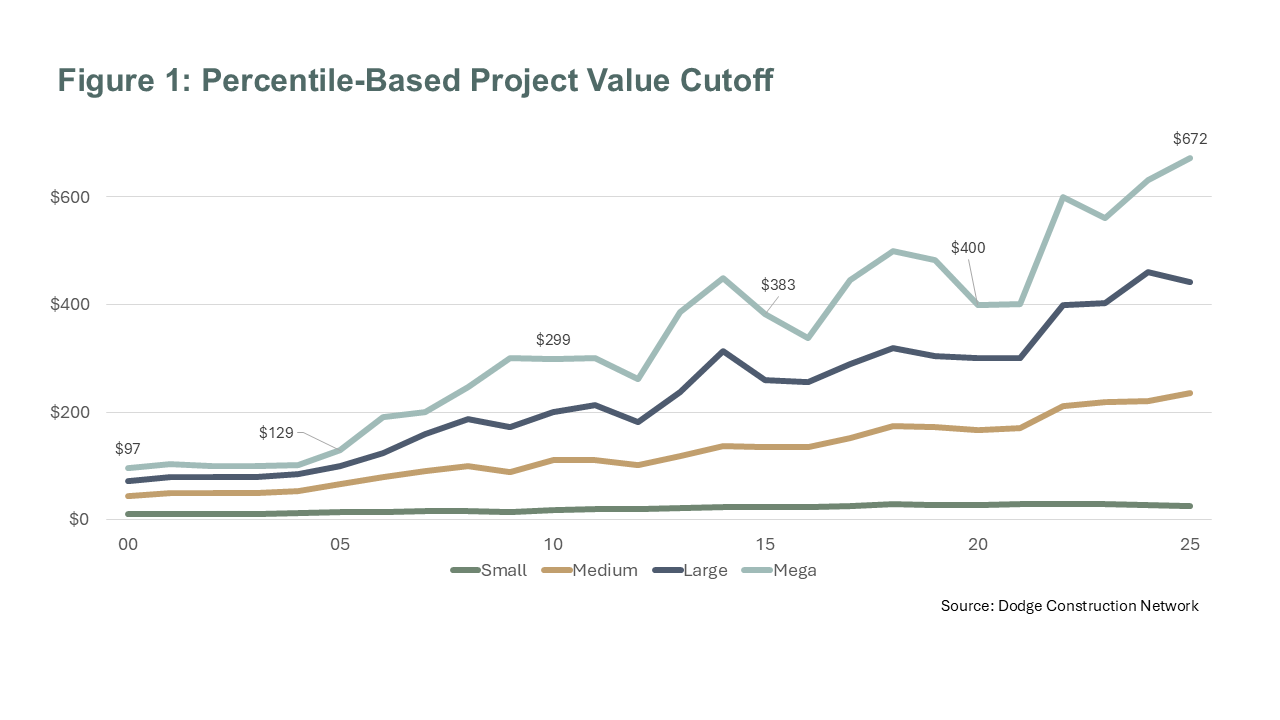

Megaprojects are often cited using static project value cutoffs, but inflation has substantially influenced costs in recent years. It’s crucial to adjust that cutoff for inflation to get an accurate understanding of how differently sized projects have trended over time. To address this, Dodge Construction Network (Dodge) defined megaprojects based on percentiles, rather than raw dollar amounts.

Dodge identified 2015–2018 as a relatively stable pre-pandemic inflationary period and used it as the benchmark for this analysis. A megaproject during this period was defined as anything valued at $400 million and above, which represented the top 0.04% of all construction projects. We then found all projects in the top 0.04% between 2016 and 2025 and categorized them as ‘mega’. We found that a megaproject in 2020, for example, would still be valued at $400 million and above, but in 2025 – that cutoff is closer to $672 million.

We then replicated this analysis for other project sizes, corresponding to small (<$25M), medium ($25M to $150M) and large ($150M to $400M). This ultimately allowed us to track the same cohort of projects over time. As Figure 1 exhibits, each group has also been affected differently by inflationary pressures. While the ‘small’ project category experienced an average increase of 4% growth in value each year, megaprojects saw an average annual increase of 10%.

High-Tech Manufacturing

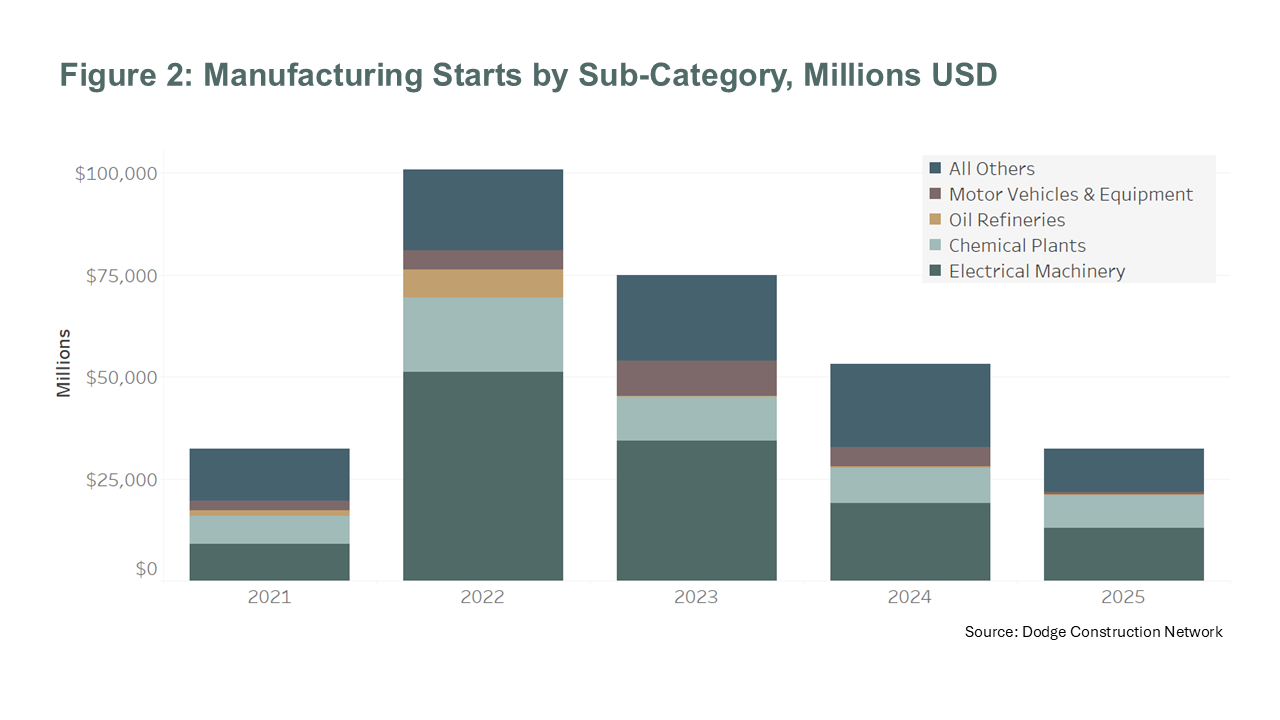

Most megaprojects over the last decade have occurred within the manufacturing sector – and, thanks to the surge in semiconductor fabrication plants and EV battery plants, that share has been on the rise. Between 2020 and 2025-Q2, manufacturing megaprojects accounted for 57% of all megaproject starts, up from 45% in the prior five years.

The CHIPS and Science Act allocated $52 billion in direct subsidies and research funding for semiconductor manufacturing, while the Inflation Reduction Act (IRA) introduced extensive tax credits for clean energy, battery production, and advanced manufacturing. The passage of these two legislations drove unprecedented levels of federal funding into semiconductor, electric vehicle (EV) and EV battery production—reshaping the largest drivers of US manufacturing activity in just a few short years. Between 2017-2021, manufacturing construction starts averaged $28 billion per year. In 2022, that value surged to a record-breaking $101 billion.

Not only are high-tech manufacturing projects extremely costly, but they are much more resource intensive, require highly specialized labor, and significantly longer construction time frames than traditional manufacturing plants. For those in the surety business, the complexity of these projects increases the risk for contractor defaults—especially given rapidly-evolving tariff policies, potential supply chain disruptions and deepening labor shortages.

After its peak in 2022, manufacturing construction has normalized to more typical, but still historically elevated, levels. Manufacturing megaprojects continue to break ground—especially semiconductor fabrication facilities—but starts are more intermittent than in 2022. Federal funding from the CHIPS and Science Act will wane in 2027 and ultimately constrain incentives to keep building semiconductors in the U.S.

The Data Center Boom

Data centers are the second largest cohort of megaprojects—accounting for 13% of total megaproject starts over the last five years. Demand for high-speed internet, cloud infrastructure and artificial intelligence are driving a surge in data center construction. While hyperscale data centers are critical to the growth of this sector, our findings revealed that momentum is shifting toward medium and large-scale developments. Medium-sized projects accounted for 31% of the total value of data center construction starts over the last five years, large-sized projects accounted for 38% and megaprojects accounted for 28%. As the data center market matures and diversifies, we’d expect the market to transition toward medium and large-scale developments. Moreso, when analyzing the data geographically, we found that companies are gradually investing in smaller, decentralized facilities located closer to end users—i.e. edge data centers.

Sufficient access to the power grid, water, and alternative sources of energy remain critical for the success of large-scale data center projects—and fundamentally determine where projects can be built. Access to these resources will determine how quickly the market can keep up with surging demand—but it’s likely the market will face major constraints in the near-term. For those in the surety business, the massive infrastructure that’s required to power these data centers makes their construction, and consequent underwriting, vastly more complex than with traditional building types.

Megaprojects for data centers remain prevalent—as investment into AI and cloud computing continues to surge and projects entering the planning queue steadily increase. The robust demand for hyperscale and edge data centers offers many opportunities for surety bonds—albeit on a very complex type of construction project.

Diversification Across Project Size

Megaprojects may dominate headlines, but they also carry outsized risks—longer timelines, complex designs, and massive resource demands make them vulnerable to delays and defaults. For surety providers, concentrating solely on these projects can expose portfolios to significant volatility, especially as megaproject starts fluctuate with federal incentives and market cycles. Diversifying across medium and large-scale projects not only spreads risk but ensures steady revenue streams and operational efficiency. These projects collectively represent a substantial share of construction activity and require less intensive underwriting, allowing surety teams to balance high-profile opportunities with consistent, manageable growth. In short, a diversified portfolio across project sizes is as critical to stability as any other form of risk management.

Sarah Martin is the Associate Director of Forecasting at Dodge Construction Network. With a decade of experience in economic forecasting, she analyzes the U.S. economy and major construction trends to produce forward-looking insights on where the U.S. construction sector is headed. Dodge Construction Network curates data on nearly every construction project breaking ground across the country, and Martin draws on this comprehensive dataset to deliver accurate, data-driven forecasts that ultimately support industry decision-making. She can be reached at sarah.martin@construction.com.

Sarah Martin is the Associate Director of Forecasting at Dodge Construction Network. With a decade of experience in economic forecasting, she analyzes the U.S. economy and major construction trends to produce forward-looking insights on where the U.S. construction sector is headed. Dodge Construction Network curates data on nearly every construction project breaking ground across the country, and Martin draws on this comprehensive dataset to deliver accurate, data-driven forecasts that ultimately support industry decision-making. She can be reached at sarah.martin@construction.com.

Get Important Surety Industry News & Info

Keep up with the latest industry news and NASBP programs, events, and activities by subscribing to NASBP SmartBrief.