From Our Leaders

NASBP Leadership Speaks

President’s Message: NASBP Building Better Through Advocacy

NASBP worked recently with several partner trade associations to support a conducive business environment for the surety industry.

Comments from the CEO: Tis’ the Season of State Legislatures—Know Your Resources

NASBP provides members these substantial, informational resources to supplement grassroots advocacy efforts.

Historic Storm, Historic Commitment—NASBP 2026 Historic Winter Surety School!

Faculty and students who participated in the NASBP Winter Surety School during a large-scale winter storm demonstrated resilience and commitment.

More Pipeline Features from January/February 2026

There Are More Articles In This Issue. Click Below to Continue Reading Articles in the January/February 2026 Pipeline

Did You Know?

Did you know that one of the many benefits of being a NASBP Bond Producer is that your firm is listed in the NASBP Surety Pro Locator, a directory of NASBP members, which is available to anyone in the general public who is seeking guidance to obtain surety credit? Members who want increased visibility for their firm in the NASBP Surety Pro Locator, can purchase a premiere listing that will appear first when someone searches the directory by state. Other benefits of the Premier Listing include:

- Company logo

- Active website, social media links, email address, and up to five contacts

- Extended company profile and products and services listing

- Integration with Google features, including search indexing and analytic reporting

- Request for information: a contact form to reach a representative from your business

A Premier Listing also includes the ability to upload a promotional video, up to 5 minutes in length.

Interested in learning more? Visit the NASBP Media Kit.

Boost Your Surety Knowledge with the NASBP Virtual Seminar Subscription

The NASBP Virtual Seminar Annual Subscription is a robust resource to help you and your staff address challenges throughout the year.

Make Surety a Career Program

NASBP provides university instructors with a classroom curriculum and college students with an online course geared for them.

Pipeline Issues Archive

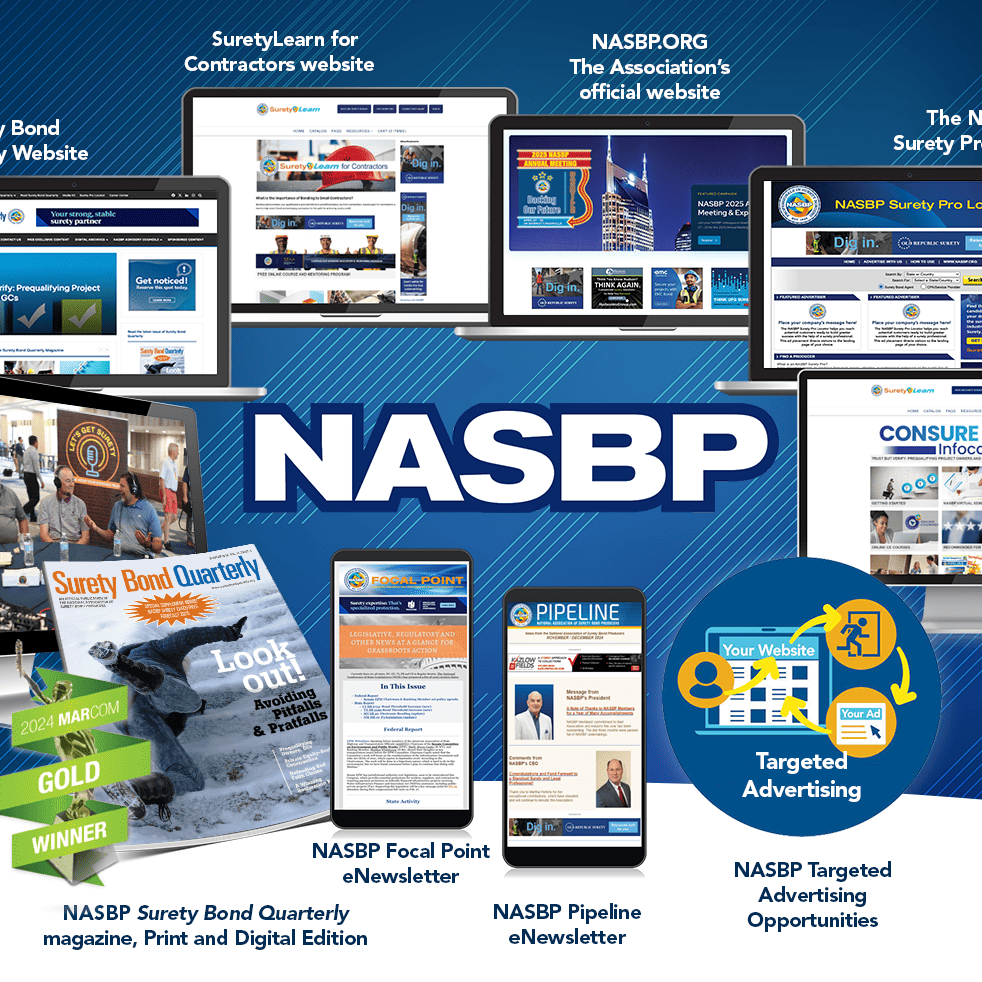

Advertise With NASBP

Build Your Brand with NASBP

Stand out in the surety industry! Advertise in NASBP programs and communications and bring your brand and expertise to the attention of NASBP Members, who are responsible for billions in written premiums every year.