By Christian Dewhurst & Jackson Moore of Gray Reed

Originally published September 16, 2025

The American construction industry continues to be shaped by the fluctuating cost and availability of materials. Early data from 2025 indicates a steady rise in material prices, driven in part by tariffs on foreign imports—some reaching as high as 50%. These increases raise concerns about potential payment disputes across the sector. This article explores legal strategies, including contract drafting and lien rights, that can help industry participants manage these challenges effectively.

The Construction Industry: Pricing Increases and Future Production Outlook

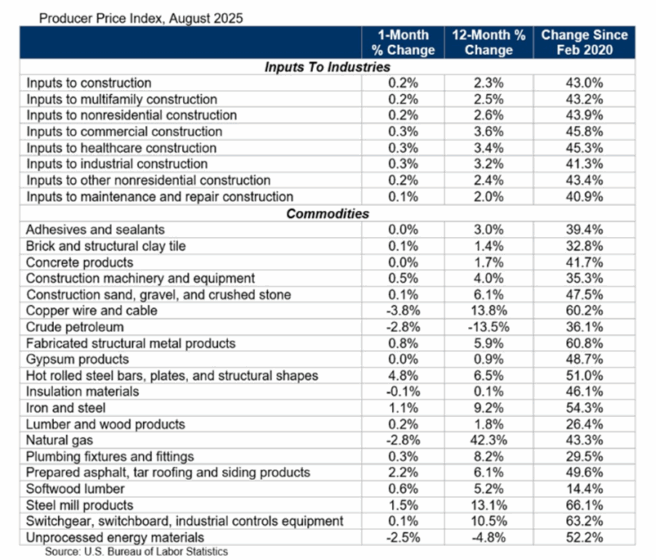

Recent figures from the Bureau of Labor Statistics show a 2.6% year-over-year increase in non-residential construction material costs. Steel mill products have surged by 13.1%, while lumber and concrete products have risen by 1.8% and 1.7%, respectively. The chart below offers a detailed breakdown of commodity-specific impacts.

See chart below for a more detailed analysis of the overall impact on various commodities:

Despite efforts to reduce reliance on imported materials like cement, lumber, and steel, domestic production still falls short of demand. According to the American Cement Association (ACA), formerly the Portland Cement Association, the U.S. imports approximately 20% of its cement annually, with Canada and Mexico supplying over a quarter of that volume. This reliance on imports means tariffs could further inflate prices.

Even domestically produced materials are not immune. Tariffs reduce foreign competition, which can lead to longer lead times and diminished pressure on domestic suppliers to maintain quality and delivery standards. The result: increased costs and reduced efficiency across construction projects.

Broader Construction Industry Implications

Rising material costs have ripple effects throughout the industry. Contractors may pass these costs to developers, who might respond by delaying or repricing projects. Public infrastructure initiatives—often bound by fixed budgets—could face funding gaps or require legislative action to stay on track. In the residential sector, higher costs may exacerbate affordability issues in already strained housing markets.

Compounding these pressures are high interest rates and inflation. President Trump has urged the Federal Reserve to cut rates to stimulate spending, and recent labor market data may prompt action. Lower borrowing costs could offer temporary relief, enabling stakeholders to move forward with projects despite elevated material prices.

However, tariffs remain a significant counterforce. By limiting supply and increasing uncertainty, they undermine the stability that the construction industry depends on. Whether rate cuts will sufficiently offset these pressures remains to be seen. For a deeper dive into how inflation and interest rates affect Texas’s construction landscape, refer to a previous Gray Reed blog post.

The Role of Contracts in Reducing Exposure to Material Pricing Uncertainty

Tariffs, inflation, and interest rate fluctuations introduce complexity and risk into construction projects. Thoughtful contract drafting can help mitigate these challenges from the outset.

Price Escalation Clauses

A concrete supplier anticipating tariff-driven cement price hikes might negotiate a price escalation clause. These clauses link pricing to external benchmarks—such as indices or published averages—protecting contractors from absorbing unexpected cost increases between bid submission and material procurement. They also promote transparency with owners by clarifying how future price changes may affect budgets.

Materials Availability Clauses

Similar to force majeure provisions, these clauses outline procedures and remedies when uncontrollable events—like tariff surges or global supply chain disruptions—make material procurement commercially impracticable. Addressing these risks upfront reduces the likelihood of disputes and provides a roadmap for resolution.

Excusable Delay Provisions

These clauses shield contractors from liability for delays caused by unforeseen events, such as global shortages or tariff-related disruptions. They typically grant additional time to complete work without penalty. Clearly defining what constitutes an excusable delay helps avoid costly legal battles. During COVID, such provisions proved invaluable in protecting contractors and suppliers from delays caused by labor shortages and supply chain breakdowns.

Ultimately, there’s no universal clause that fits every project. Each presents unique risks, and stakeholders should tailor contracts to address specific challenges. Even minor adjustments can mean the difference between a manageable issue and a costly dispute.

Protecting Payment Through Lien Rights

As material prices climb and project costs escalate, the risk of nonpayment grows. In addition to contractual protections, Texas law offers robust remedies through its mechanics and materialmen’s lien statutes.

Anyone in the construction industry knows the frustration of watching accounts receivable balloon on a project where payment seems out of reach. Fortunately, Texas lien law provides a safety net.

A mechanic’s lien allows contractors and suppliers to assert a legal claim against the property where work was performed or materials delivered—dramatically improving the odds of getting paid.

To perfect a lien in Texas, specific procedural steps must be followed:

- Pre-lien notice to the property owner and general contractor.

- Filing a lien affidavit in the county’s real property records.

- Sending notice of the recorded lien to relevant parties.

Each step is subject to strict deadlines based on when work was completed or materials delivered. Missing these deadlines can result in an unperfected lien, weakening the ability to enforce payment.

Lien laws vary by jurisdiction, so contractors and suppliers—especially those operating across state lines—must understand the specific requirements in each location. While Texas’s lien statutes can be complex, those who comply are far better positioned to recover payment from delinquent parties.

Conclusion

Tariffs, inflation, and rising material costs pose real challenges to the construction industry. But with strategic contract drafting and a firm grasp of lien rights, contractors, suppliers, and developers can protect their interests and continue building with confidence in a volatile market.

Christian Dewhurst is a Partner with Gray Reed. His practice is primarily focused on resolving the entire spectrum of claims and litigation that arise during commercial and residential construction projects. He can be reached at cdewhurst@grayreed.com or 713.986.7186.

Jackson Moore is an Associate with Gray Reed. His goal is to provide clients with effective, results-oriented representation while maintaining clear communication and a collaborative approach throughout the litigation process. He can be reached at jmoore@grayreed.com or 713.986.7110.

Get Important Surety Industry News & Info

Keep up with the latest industry news and NASBP programs, events, and activities by subscribing to NASBP SmartBrief.