By Eric Gaus of Dodge Construction Network

As the government shutdown stretches into its sixth week, Dodge has assessed its potential effects on the construction sector using Moody’s 12-week economic scenarios. Our analysis finds that while some regions and market segments may feel disproportionate pressure, the overall national impact remains modest. The construction industry will face very slight headwinds if the government shutdown lasts for a full quarter, and the surety and reinsurance markets should come away largely unscathed.

A government shutdown impacts the economy directly through less income to government employees, and indirectly through those employees reducing their consumption because of less income. Those second order effects carry a large amount of uncertainty since the decision to curtail spending depends on a household’s current savings buffer, their social safety net, and their beliefs over the length of time before receiving back pay. Given that uncertainty, Moody’s prepared two scenarios which vary in severity but maintain the same time period of government inactivity, 12 weeks.

In those scenarios, real GDP growth takes a hit of roughly 1.5 to 2 annualized percentage points in the fourth quarter of 2025 and rebounds to baseline levels of real GDP by the end of 2026. From Dodge’s perspective, this slowdown has a limited impact on construction starts since the volume of activity from federally funded projects is relatively small and those projects are likely to just be deferred to later as opposed to abandoned. The impacts on construction projects that are already underway will likely be higher since, in addition to government projects being delayed, a lack of federal services will reduce productivity of private projects as well.

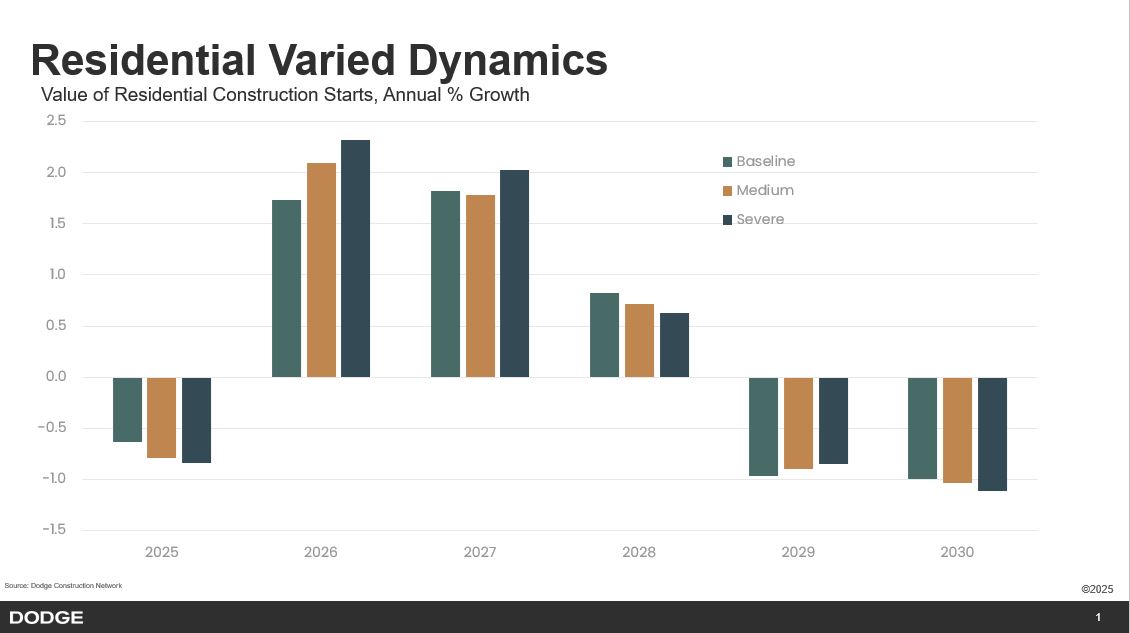

The slower Q4 growth and stalled out public housing projects reduces our growth forecast for the residential market in 2025 slightly, with a strong rebound in 2026 (see Chart 1). The extra growth comes from the natural dynamics of extra projects combined with a more positive GDP outlook. With its smaller project sizing, single family reacts one to two quarters more quickly than multifamily. This initial shock reverberates through the forecast as the subtle increases in the number of units under construction in early 2026 alters supply and demand decisions causing a flip-flopping of growth in the back half of the forecast.

Chart 1

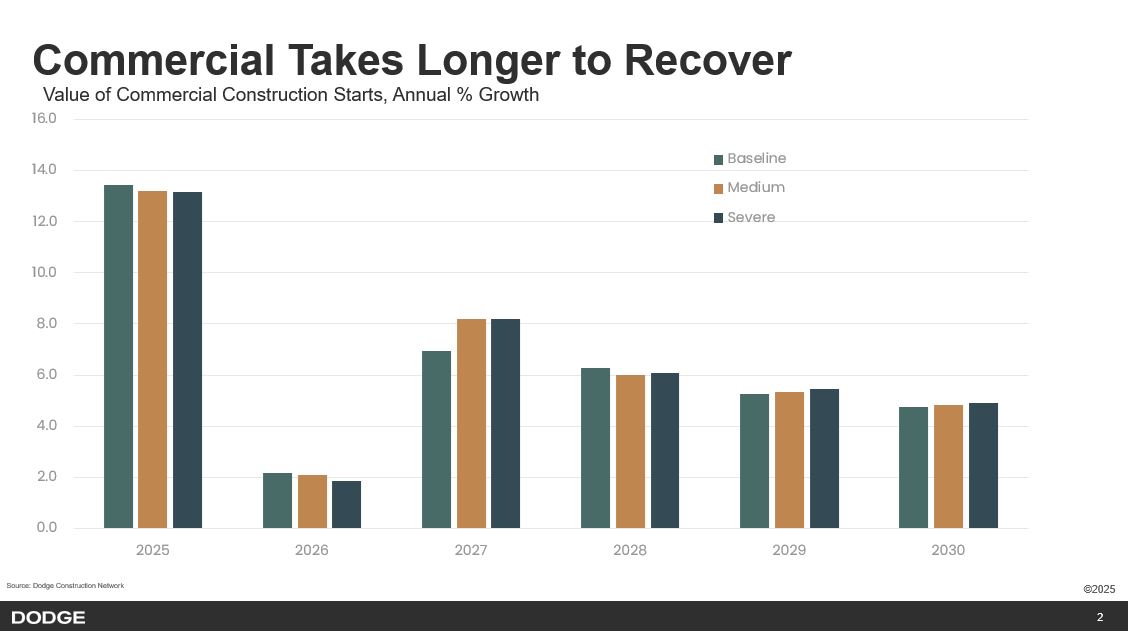

On the commercial side, the impacts are spread through the end of 2026 with a recovery manifesting in 2027 (see Chart 2). Privately funded commercial projects are less subject to federal funding and therefore only see a residual impact of a more sluggish economy and the accompanying depressed sentiment. As with the residential forecast, the back half of the forecast exhibits echoes of the initial shock.

Chart 2

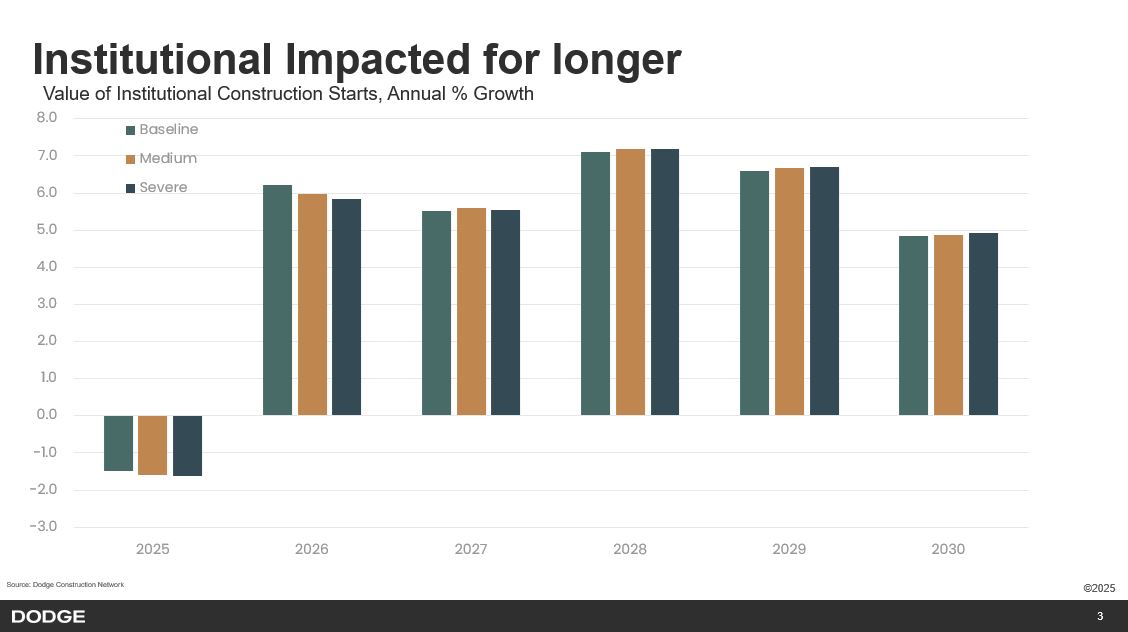

Institutional construction bears the brunt of the government shutdown as many of the projects within this category rely on federal funding (see Chart 3). Much of the decline would not be from abandoned projects, but rather projects that are held up due to a lack of progress made during the planning process. The temporary hiatus takes a while for the relevant parties to get projects back on track, and recovery takes a long time. Institutional construction starts do not get back on par until the very end of the 5-year forecast horizon.

Chart 3

For the surety and re-insurance market, these results imply that well diversified, and risk-aware companies should be able to navigate these scenarios gracefully. Those who are overweight in government-backed projects, however, should carefully navigate the next few months. The pipeline of new contracts is likely to weaken the longer the shutdown persists, but it is unlikely that many projects will trigger payouts outside of statistical confidence intervals. All that said, our current expectations are that the negotiations to reopen the government will conclude by Thanksgiving.

Eric Gaus is Chief Economist at Dodge Construction Network, where he directs economic research. He brings over 15 years of experience in academia and the private sector, creating macroeconomic models and producing research on critical issues for the global economy. Prior to joining Dodge, Gaus was a Director at Moody’s, where he managed the development and maintenance of their global forecasting model and served as the product manager of their country risk service. He received his PhD from the University of Oregon and spent several years teaching at small liberal arts colleges. While in academia, Gaus published articles on the role of expectation formation in macroeconomics and finance. He can be reached at Eric.Gaus@construction.com.

Eric Gaus is Chief Economist at Dodge Construction Network, where he directs economic research. He brings over 15 years of experience in academia and the private sector, creating macroeconomic models and producing research on critical issues for the global economy. Prior to joining Dodge, Gaus was a Director at Moody’s, where he managed the development and maintenance of their global forecasting model and served as the product manager of their country risk service. He received his PhD from the University of Oregon and spent several years teaching at small liberal arts colleges. While in academia, Gaus published articles on the role of expectation formation in macroeconomics and finance. He can be reached at Eric.Gaus@construction.com.

Get Important Surety Industry News & Info

Keep up with the latest industry news and NASBP programs, events, and activities by subscribing to NASBP SmartBrief.