From Our Leaders

NASBP Leadership Speaks

President’s Message: Volunteer for a NASBP Committee and Receive a Bountiful Return on Your Investment

Serving on a NASBP committee is a terrific way to meet people in our industry that you may not have the opportunity to meet otherwise.

Comments from the CEO: Thank You NASBP Community and Best Wishes for 2026!

Find out how NASBP members aided and advanced surety interests and that of the greater NASBP community this year.

Grow Your Surety Knowledge with a 2026 NASBP Virtual Seminar Subscription Package

This package includes registration, recording access for all 2026 NASBP Virtual Seminars and the entire library of NASBP Virtual Seminar Recordings.

More Pipeline Features from November/December 2025

There Are More Articles In This Issue. Click Below to Continue Reading Articles in the November/December 2025 Pipeline

Did You Know?

You can browse past issues of NASBP Surety Bond Quarterly starting with the summer 2018 issue at the issue library. Peruse the issues or search by a specific keyword to find relevant articles. There is also a repository of past Special Supplements if you’d like to see previous interviews with surety executives and surety industry service providers.

NASBP Surety Bond Quarterly issues from 2014-2018 can be viewed as PDFs on the SBQ website.

Boost Your Surety Knowledge with the NASBP Virtual Seminar Subscription

The NASBP Virtual Seminar Annual Subscription is a robust resource to help you and your staff address challenges throughout the year.

Make Surety a Career Program

NASBP provides university instructors with a classroom curriculum and college students with an online course geared for them.

Pipeline Issues Archive

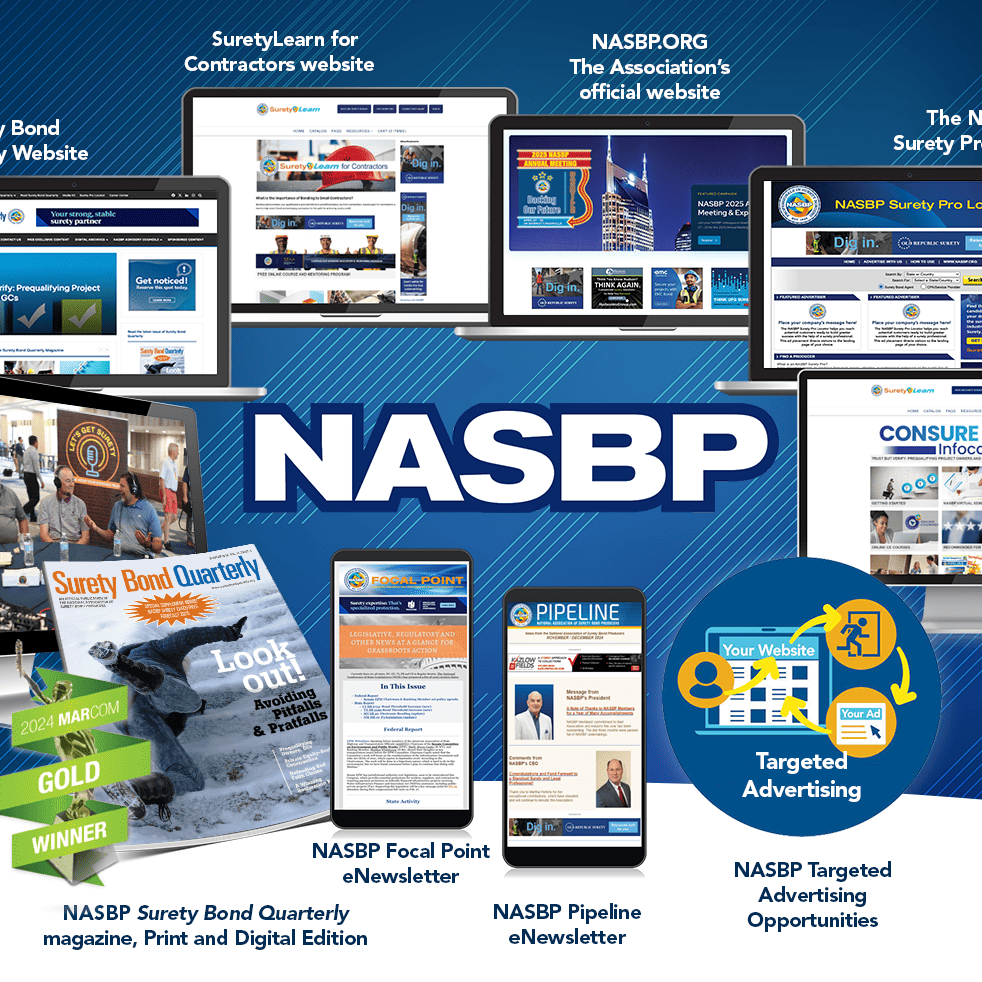

Advertise With NASBP

Build Your Brand with NASBP

Stand out in the surety industry! Advertise in NASBP programs and communications and bring your brand and expertise to the attention of NASBP Members, who are responsible for billions in written premiums every year.