By Chad Bell, Senior Manager, CBIZ

Tracking working capital levels is particularly crucial in the construction industry, as the level of working capital on a company’s balance sheet impacts their ability to operate smoothly, begin new projects, and qualify for additional bonding. Working capital is defined as current assets minus current liabilities. Current assets include cash, accounts receivable, inventories, underbillings, and other current assets. For bonding purposes, current liabilities usually include debt, and any current portion of debt, accounts payable, overbillings, accrued expenses, and other current liabilities. The underbillings (an asset) represent when the billings are less than the costs and profit earned to date. The overbillings (a liability) represent when billings exceed the cost plus profit earned to date.

Tracking working capital levels is particularly crucial in the construction industry, as the level of working capital on a company’s balance sheet impacts their ability to operate smoothly, begin new projects, and qualify for additional bonding. Working capital is defined as current assets minus current liabilities. Current assets include cash, accounts receivable, inventories, underbillings, and other current assets. For bonding purposes, current liabilities usually include debt, and any current portion of debt, accounts payable, overbillings, accrued expenses, and other current liabilities. The underbillings (an asset) represent when the billings are less than the costs and profit earned to date. The overbillings (a liability) represent when billings exceed the cost plus profit earned to date.

While various surety companies may calculate working capital differently, many sureties focus on truly liquid assets and immediate liabilities. Specific to the percentage of completion accounting (standard accounting methodology with most construction companies), the relationship between underbillings and overbillings can provide insight into project flow, the rate of billing, and revenue recognition. Generally speaking, construction companies tend to record a higher level of overbillings relative to underbillings, which can improve the company’s cash position and allow for protection against customer default.

An appraiser should review the subject company’s historical and industry-specific working capital levels as part of the valuation process. In the review of many balance sheets of construction companies, we have observed a trend in working capital among small and mid-size contractors: working capital, as compared to revenue, has been trending over the last 10 years.

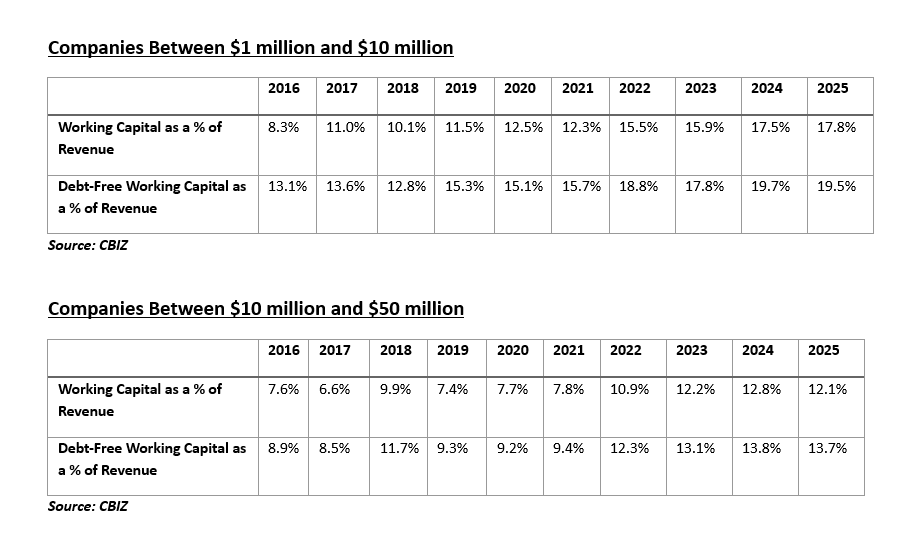

To further investigate this trend, we reviewed the industry’s working capital using Risk Management Association (RMA) benchmarks. RMA collects information from financial statements provided to lending institutions and groups them by industry NAICS codes. It provides a further breakdown of the data for a given industry for companies of various sizes based on revenue or total assets. Our analysis used the RMA data for companies within NAICS Code 23622P: Commercial and Institutional Building Construction. We reviewed 2016 through 2025 for companies with revenue from $1 million to $10 million and those with revenue from $10 million to $50 million.

The results are as follows:

This data shows that from 2016 through 2025, working capital (as a percentage of revenue) has climbed from 8.3% to 17.8% for smaller construction companies and from 7.6% to 12.1% for mid-size construction companies. If we examine debt-free working capital, that number has climbed from 13.1% to 19.5% for the smaller companies and 8.9% to 13.7% for the mid-size companies. This is a significant increase within the construction industry.

There could be many reasons behind this trend. The Paycheck Protection Program (PPP) provided a one-time injection of cash to many construction companies in fiscal years 2021 through 2023. Additional companies have built up cash reserves while making lower distributions to shareholders. Additionally, revenue growth has been hampered by the higher interest rate environment. If revenue does not grow in tandem with working capital, the working capital ratios will increase.

It is important to note that this trend does not hold for all sub-industries within construction and contracting. The 2025 National Subcontractor Market Report reported that, among subcontractors, unpredictable pay and cash flow instability continue to plague certain subcontractor industries.¹ Each company and industry must be reviewed carefully to ensure that companies carry enough working capital.

From a valuation perspective, higher industry levels of working capital could indicate: (1) that companies are generally retaining higher levels of capital, or (2) that companies are requiring more capital to sustain revenues. The appraiser must carefully determine the difference between these sentiments to assess whether a discretionary decision on the part of the Board to retain higher levels of working capital, or if industry/economic conditions have morphed, and that, to sustain operations, the company must retain more capital.

What does this mean for the surety industry? Higher working capital levels contribute to a construction company’s ability to secure higher bonding levels. Alternatively, the higher level of working capital could result in being considered a lower risk to the surety. In some instances, general contractors have excess bonding capacity, as they may not secure the contracts necessary to come close to bonding limits.

Assessing whether higher working capital reflects healthier reserves or a greater need to sustain operations remains critical. Understanding these dynamics is essential for surety and construction companies alike as they navigate an evolving market environment.

Chad Bell is a Senior Manager in CBIZ’s Valuation and Litigation Support Services group, specializing in ESOP transactions, fairness opinions, and consulting. He has extensive experience advising middle-market companies nationwide on business valuations for ESOPs, M&A, and litigation matters, and frequently speaks at national ESOP conferences. He can be reached at Chad.Bell@cbiz.com or 203.781.9679.

Chad Bell is a Senior Manager in CBIZ’s Valuation and Litigation Support Services group, specializing in ESOP transactions, fairness opinions, and consulting. He has extensive experience advising middle-market companies nationwide on business valuations for ESOPs, M&A, and litigation matters, and frequently speaks at national ESOP conferences. He can be reached at Chad.Bell@cbiz.com or 203.781.9679.

Get Important Surety Industry News & Info

Keep up with the latest industry news and NASBP programs, events, and activities by subscribing to NASBP SmartBrief.